Why Buying a Home Now Is Still Smarter Than Renting - Even with Higher Interest Rates

If you’re currently renting but have been dreaming of owning your own home, you’re not alone. Many renters hesitate to make the leap to homeownership—especially with today’s higher interest rates. However, buying a home now can still be a smarter financial move than continuing to rent. In this post, we’ll explore why purchasing a home offers both short and long-term benefits, and how First America Homes’ incentives can make buying a home even more attractive.

The Cost of Renting vs. Owning

Let’s face it—renting can feel like throwing money away. Your monthly rent payments go straight to your landlord without building any equity for you.

Consider this: if you’re paying $2,000 a month in rent, that’s $24,000 a year with nothing to show for it. Over five years, that’s $120,000 paid to your landlord. With a mortgage, those payments could be building wealth for you instead.

Short-Term Benefits of Buying Now

- Incentives to Reduce Upfront Costs:

First America Homes makes it easier to buy by offering incentives like lower interest rates and money toward closing costs. These savings can significantly reduce the amount of cash you need upfront. - More Predictable Payments:

With a fixed-rate mortgage, you’ll have consistent monthly payments, unlike rent payments that can rise at lease renewal. This stability makes budgeting easier and helps you plan for the future. - Freedom to Personalize:

As a homeowner, you can paint, renovate and decorate however you like without needing a landlord's permission. You’ll be investing in your own property instead of someone else’s.

Long-Term Benefits of Homeownership

- Building Equity:

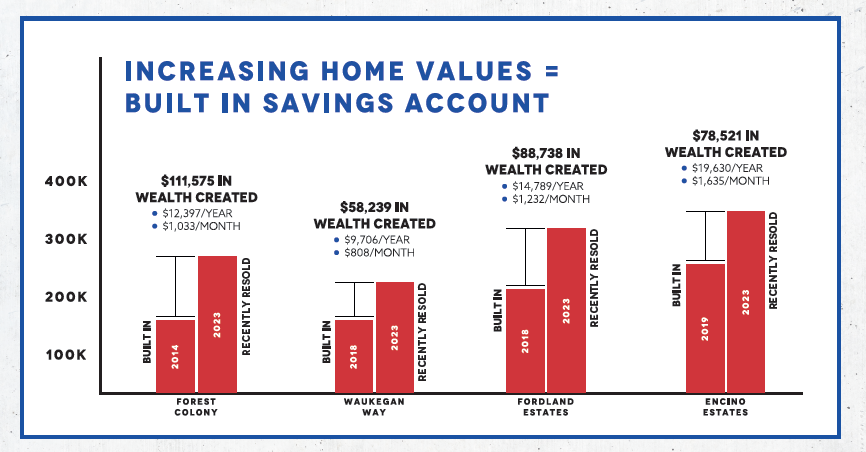

With each mortgage payment, you’re building equity—a form of savings that grows over time. When you rent, none of that money comes back to you. - Appreciation Potential:

Historically, home values tend to appreciate over time. That means the longer you own your home, the more it could be worth. - Tax Advantages:

Homeowners can often deduct mortgage interest and property taxes, which can lower your taxable income. Renters miss out on these tax benefits. - A Hedge Against Inflation:

With a fixed-rate mortgage, your monthly payments won’t rise even if inflation pushes rent prices higher. In the long term, this can save you a significant amount of money.

Why Buy Now Despite Higher Interest Rates?

Today’s interest rates are higher than a few years ago. However, waiting for rates to drop could cost you in the long run if home prices continue to rise. Potential to Refinance: Interest rates fluctuate. By purchasing now, you can start building equity right away and refinance to a lower rate if they drop in the future.

- Inventory and Incentives: First America Homes offers special incentives to offset higher rates including reduced interest rates and covering a portion of your closing costs.

- Locking in Your Payment: Buying now lets you lock in a fixed payment, protecting you from rising rent prices.

Ready to Stop Renting and Start Investing in Your Future?

If you’re tired of watching rent prices go up with nothing to show for it, now is a great time to explore your homeownership options. Contact First America Homes today to learn more about our available homes and current incentives. Your dream home - and a smarter financial future - could be closer than you think!